Sharpen Your SPY 0DTE Options Trade Strategies

Check back daily as Options Retriever updates each trading day. Available upon request for other indices and asset classes such as cryptocurrency. This site is for educational and demonstrative purposes only and is not intended as trade recommendations. Data is delayed.

Gamma Capture Strategy Finder:

Our Strategy Finder picks the options strategy best suited for current intraday volatility of either HIGH/LOW and the market environments of BEAR/NEUTRAL/BULL. The combination of volatility plus market direction significantly increases your chances of success.

We select the S&P 500 (SPY) 0DTE options strategies with the highest probability setups and place trades based on specific market parameters.

Gamma Capture Intraday Vol:

The innovative measure uses tick data to decide whether same day SPY 0DTE option’s implied volatility is high or low. Options containing lower (higher) levels of implied volatility will result in cheaper (more expensive) option prices.

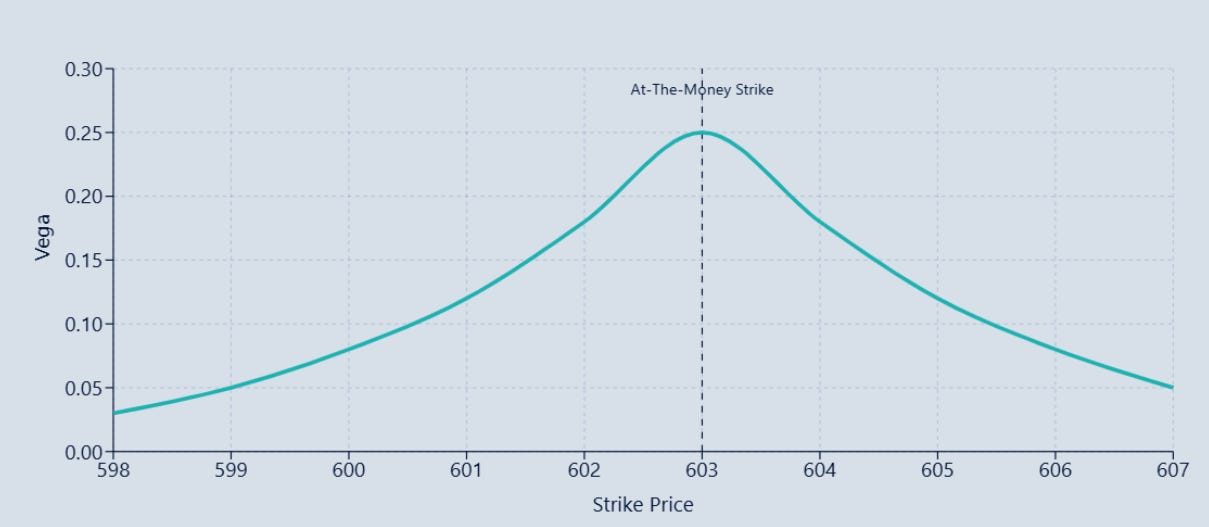

SPY 0DTE options vega is very important. Vega is the option Greek that measures the expected change in an option's price for a 1.00% increase or decrease in implied volatility. SPY 0DTE At-The-Money options can gain or lose as much as $0.20 for each 1.00% change in volatility. Our Gamma Capture Theo Price is calculated using Gamma Capture vol. Comparing the Theo price to market prevailing price will help determine if an option is a buy or a sell.

ML Decision Tree:

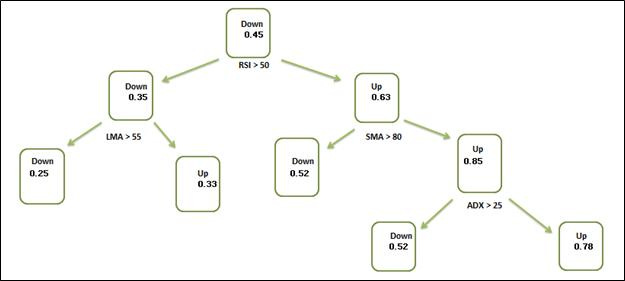

The Machine Learning Decision Tree categorizes the market as either Bearish, Neutral or Bullish. The data is split based on Technical Indicators along each branch of the tree. We use Technical Analysis indicators (SMA, LMA, RSI, MACD, ATR, ADX) along with several proprietary input variables to inform the tree.

Data Mining with Decision Trees

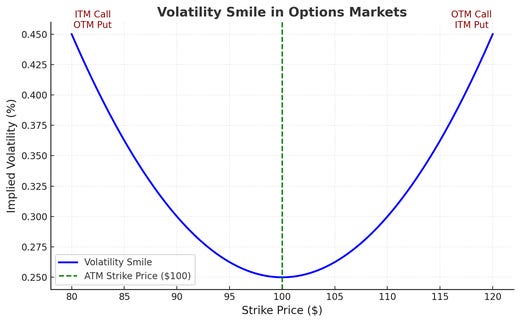

Volatility Smile:

Skewness trades employ buying and selling options that are Out-of-The-Money to profit from the non-symmetrical implied volatility smile. Out-of-The-Money upside and downside ivol is considered when determining an options strategy.

News Override Alert:

Large market movements are triggered by news announcements such as economic reports, earnings releases, or geopolitical events. News trading can be risky due to volatility and the unpredictable nature of market reactions.

Market Analysis:

Our technology explores the S&P 500 through various lenses to uncover meaningful insights into market price and volatility dynamics.

SPY ETF Options Prices

0DTE Key Points

0DTE options are highly sensitive to market changes due to their short lifespan, making them suitable for day traders.

Enter trades between 10:00-11:00 AM EST and exit before 3:30 PM.

ETF Options like SPY 0DTE Expire at 4:15 PM EST and have physical settlement. Exit trades prior to 3:30 PM to avoid being assigned unwanted SPY positions and rapid theta decay.

Increase or add to your sell size during low volatility days.

Include iron condors and vertical spreads help to balance potential gains with risk. Short naked options are calls or puts that are sold that have nothing to limit their risk. We do not recommend selling naked options.

Utilize tools such as technical analysis, historical data, backtesting, and implied volatility indicators to make more informed decisions.

Set realistic profit targets. 0DTE trades can yield a very wide range of returns with commensurate risk. Aim for a range consistent with your risk/return goals.

Disclaimer

Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.